Artificial intelligence has moved from the fever pitch of hype into the more demanding terrain of real-world application. Valuations are recalibrating, capital is becoming selective, and only a subset of players will emerge as lasting leaders. At DWM Investment, we believe this is the moment when disciplined investors can move from speculation to substance.

The Cooling of the AI Frenzy

In 2023 and 2024, the AI market was defined by record fundraising rounds, inflated valuations, and a rush of capital into companies whose business models were often untested. That wave has now broken. Rising capital costs, tougher enterprise adoption cycles, and investor fatigue have separated short-term hype from durable opportunity.

We view this cooling not as a setback but as a healthy reset. It shifts the advantage toward investors who can evaluate the operational viability of AI technologies rather than betting on market sentiment.

Where Real Value is Emerging

In our experience, the AI market’s enduring value will not be driven by consumer-facing novelty. It will come from infrastructure and applied solutions embedded in industries with high barriers to entry. Areas we see as most compelling include:

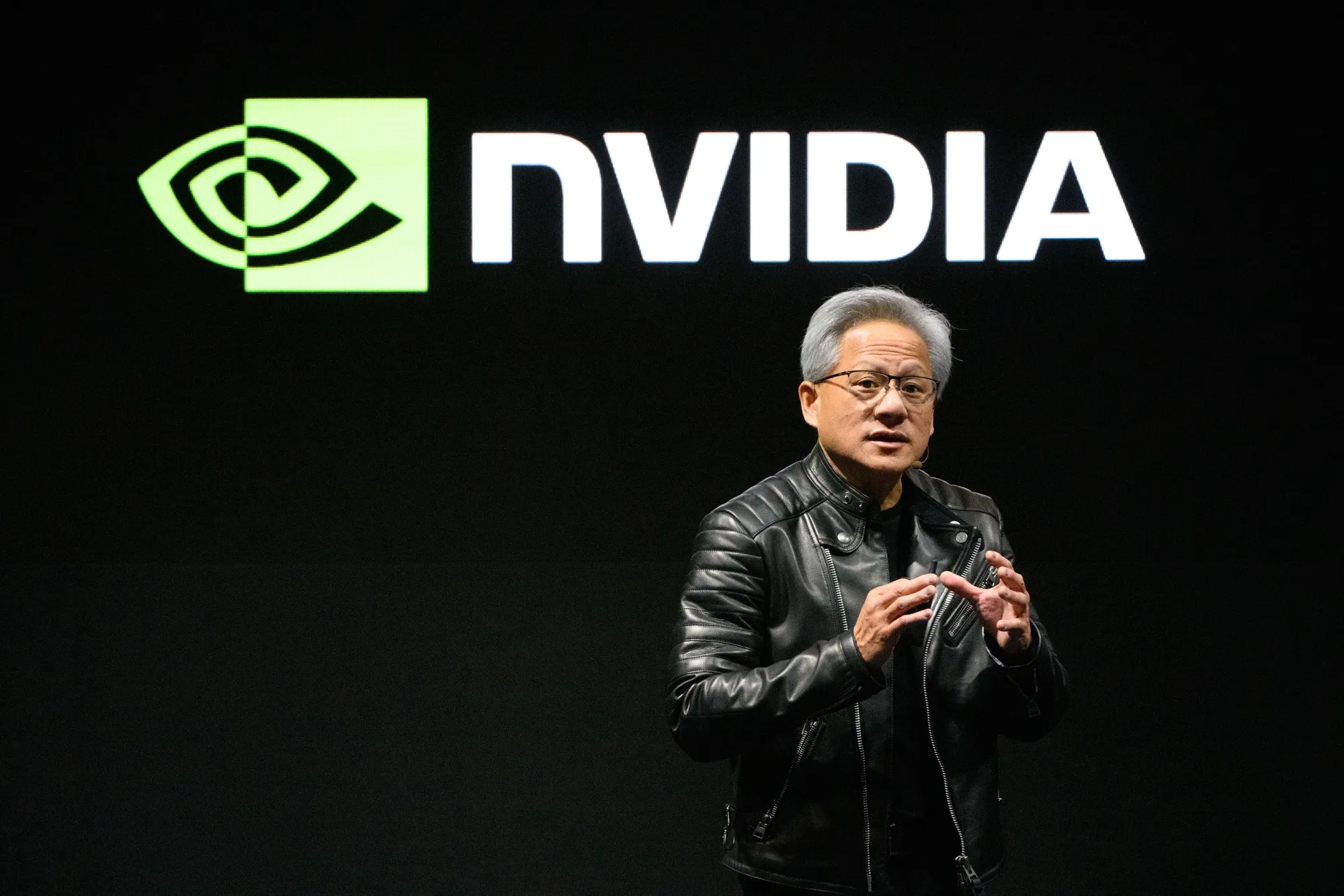

- AI Infrastructure: Specialized semiconductors, energy-efficient data centers, and secure cloud architectures designed for heavy computational loads.

- AI in Mission-Critical Systems: Defense, aerospace, and space technology applications where reliability and security are paramount.

- Industrial and Supply Chain AI: Predictive maintenance, logistics optimization, and risk monitoring that directly impact cost efficiency and uptime.

- Healthcare AI: Accelerating diagnostics, personalized treatment plans, and operational efficiency in healthcare delivery systems.

DWM’s Approach: Patience and Precision

We invest in AI with the same mindset we bring to any high-barrier sector. That means:

- Partnering with Operators: Working with founders and operators who understand the operational and regulatory complexity of their target industry.

- Evaluating Defensible IP: Prioritizing companies with proprietary algorithms, datasets, or deployment models that are difficult to replicate.

- Scaling with Discipline: Providing growth capital only after product-market fit is proven in environments where switching costs are high and adoption cycles are sticky.

The Role of Private Capital in AI’s Next Phase

Public markets often overreact to short-term AI narratives. Private capital has the advantage of time and proximity. By engaging closely with technical teams and customer ecosystems, we can identify and support the subset of companies capable of delivering measurable ROI for their customers.

We believe AI’s next decade will be defined not by the sheer number of AI companies but by the handful that integrate so deeply into critical systems that they become indispensable. DWM’s role is to help those companies get there.